Register Car In California Sales Tax

If you sell only occasionally or for less than 90 days a year and you don t have california tax nexus you might qualify for a temporary sellers permit.

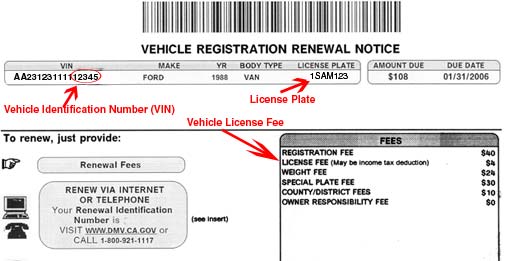

Register car in california sales tax. To prevent subterfuges two requirements are imposed. No sales or use tax is imposed when a california resident imports a car that he owned licensed and used in another state. Purchasers can pay use tax either to the department of motor vehicles dmv when they register the vehicle or directly to the board. The sales tax rate is generally the rate that applies where the vehicle is sold. For example a buyer from a county that charges only 7 75 percent sales tax will save money on taxes even if he buys from a county with a higher sales tax rate.

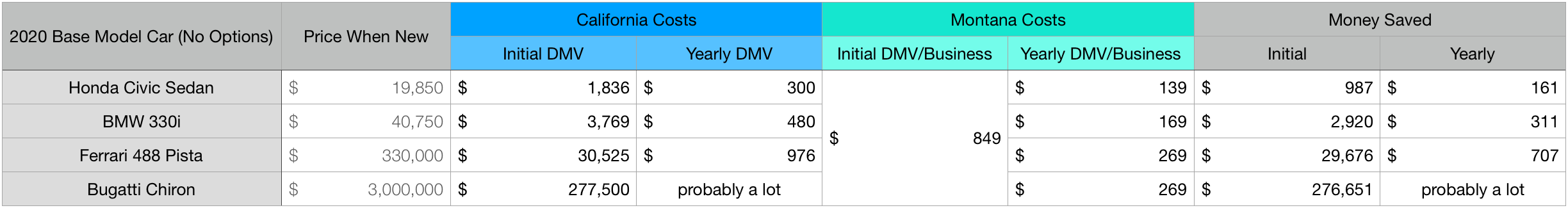

Sales use tax in california. Average dmv fees in california on a new car purchase add up to 244 1 which includes the title registration and plate fees shown above. You can register for a california sales tax permit online at the california department of tax and fee administration cdtfa by clicking register then register a new business activity. The sale of three or more items on which california sales tax is due in one year triggers the requirement to register for a seller s permit in the state. 1 the car must have been registered in the other state for at least 90 days until recently the requirement was one year.

And 2 the owner must have actually used. California sales tax generally applies to the sale of vehicles vessels and aircraft in this state from a registered dealer. California documentation fees. Next drive the car to your nearest smog station to make sure it passes california s emission regulations. Alternatively you may register in person at one of their field offices.

California exempts some vehicle sales to individuals by non dealers. Avalara registration services can help you get the required california seller s. To register your out of state car in california start by locating your current title or registration and bill of sale to prove that you own your car. Cash price refers to the price of the vehicle without including any additional charges such as tax document dealer licensing registration fees financing charges or warranties etc. Retailers engaged in business in california must register with the california department of tax and fee administration cdtfa and pay the state s sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Sales tax on the cash price paid for the vehicle is due if the vehicle was purchased within 1 year from the date the vehicle entered ca. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)