How To Register Ppp In Quickbooks

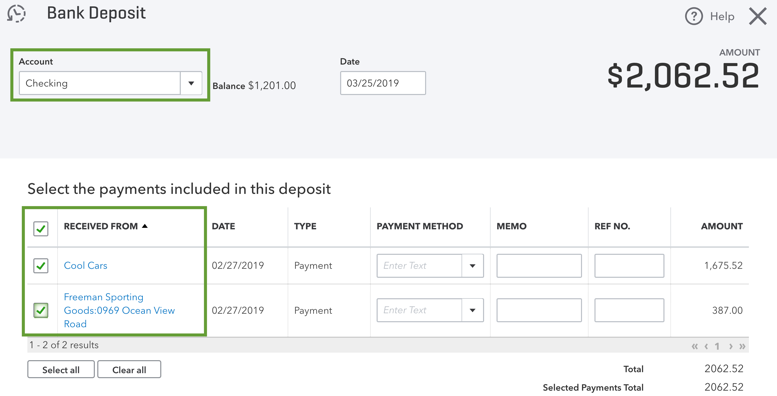

Then craft a report to show that you spent the money on payroll utilities and rent.

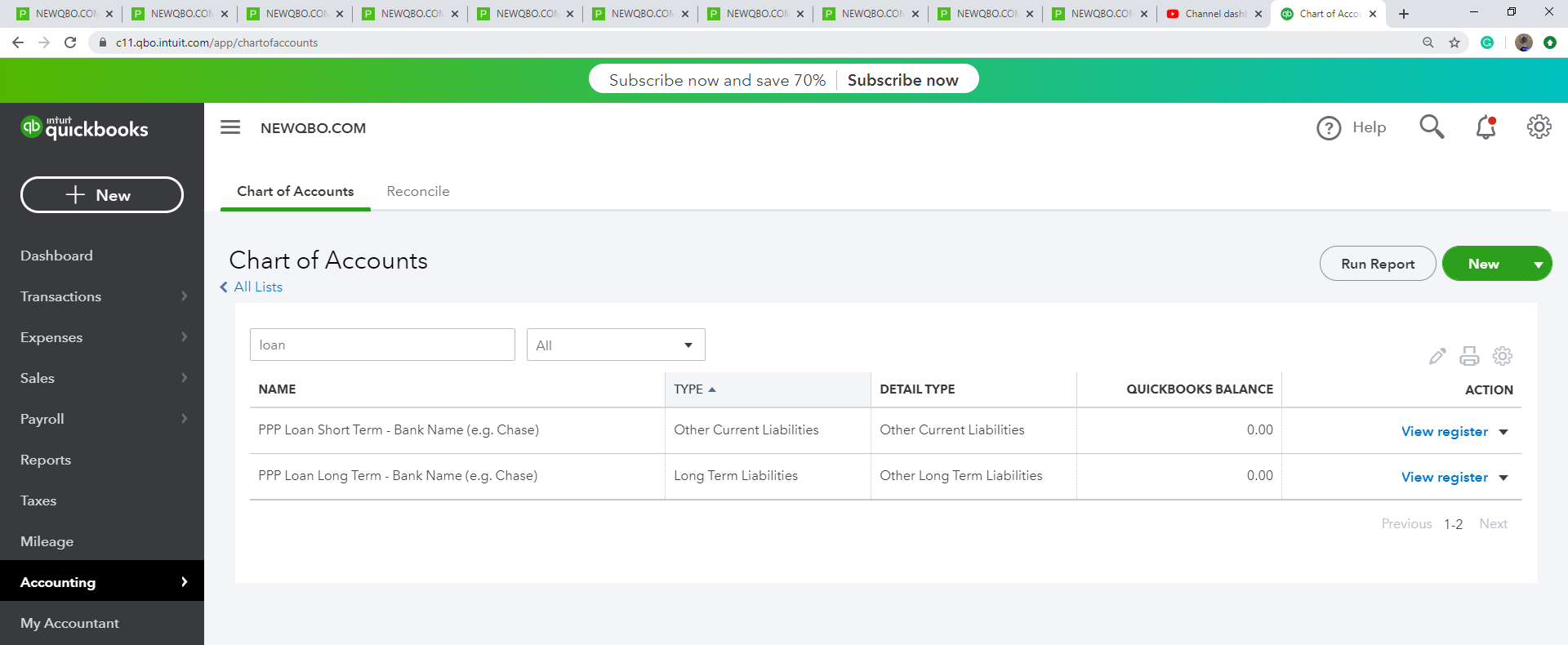

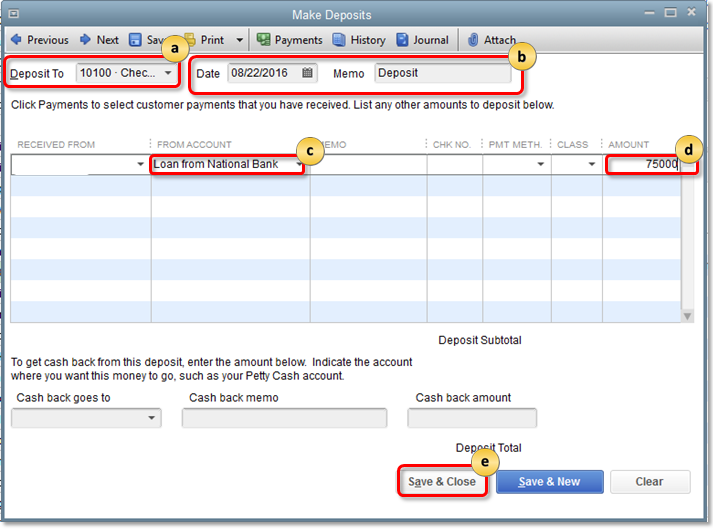

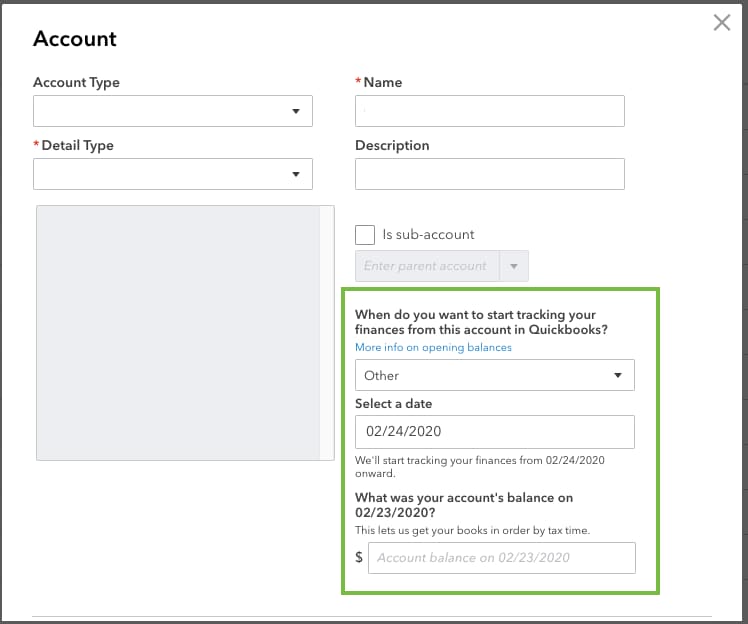

How to register ppp in quickbooks. Select bank click continue. New to intuit s quickbooks is the paycheck protection program ppp center and the latest update adds a loan forgiveness estimator and ppp specific reports to quickbooks online among other tools. 1 create a sub account to the bank account in the chart of accounts. In the chart of accounts select account then select new. In qbd and qbo the bank register will display the ppp check separated by a dark horizontal line since the ppp check at a later date than today s date.

The monies received and paid. That will open up the chart of accounts screen with the list of all of your accounts. In a few days look for part ii. Ppp loan without opening a separate bank account. Jody linick is an aipb certified bookkeeper a quickbooks certified pro advisor and a member of the intuit trainer writer network.

In the top right click new to create a new account. The idea would be that you can run a profit and loss by class report at the end of the loan spend period to easily find your ppp. So that is record in case your are audited for the same. Click sub account of and choose the bank account from the drop down. Click save and close.

Quickbooks help on how to record the ppp paycheck protection program and eidl economic injury disaster loan activities i e. Enter a name for the account like ppp loan funds. Additionally if you have quickbooks online plus you can add a class called ppp and tag expenses to it. Join this cpe webinar to learn how to manage your ppp loan in quickbooks online using classes checking sub accounts and tagging. Qbo has ready report available for the same.

Creating a liability account to record loans in quickbooks online navigate to your chart of accounts by selecting accounts on the left hand side and choose chart of accounts.